Introduction

Compound annual growth rate returns which represents the average annual growth of investment over a given time interval or specific period. When returns earned from previous investments are re-invested for future growth and it gives an accurate picture return if you compare with a simple average of annual return.

What is CAGR?

The compounded annual growth rate (CAGR) is one of the most accurate ways to calculate and determine returns for anything that can increase or decrease in value over specific period of time. CAGR is most effective if you compare this return with any alternate or it is most effective when it compare with industry wise return.

Use of CAGR?

The compound annual growth rate of return is a very useful technique to compare and determine the return effectively, we should not consider annual return rather we should determine or measure the compound annual growth rate of return (CAGR). We use CAGR in mutual funds, stocks, real estate. We will understand the CAGR in an example but first, we will discuss the CAGR formula, To compare the performance of different investments over the same period, To evaluate the long-term growth potential of investments, To make investment decisions about portfolio allocation.

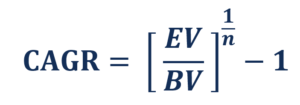

Formula CAGR

Where:

- EV:- Ending Value

- BV:- Beginning Value

- N:- Number of Compounding Periods

- CAGR:- Compound Annual Growth Rate

Example of CAGR

Let’s understand with an example when a person invested 10000 Rs for 5 years and invested amount becomes 15000 so let’s put value in the formula:-

((Ending Value/Beginning Value)^1/5)-1

CAGR = 0.08447 or 8.45%

Herr 8.45% is showing on an average of total investment.

Advantage of CAGR

1- CAGR shows and gives an accurate picture for long-term investment.

2- CAGR helps investors to compare the several alternate investment options so investors can choose better investments.

3- CAGR reduces the risk of volatility and market fluctuation.

4-CAGR can be used as a benchmark to compare the performance of an investment against industry standards or other investments.

Disadvantage of CAGR

1- It is not realistic because it assumes a constant growth rate throughout the analysis.

2- CAGR ignores volatility which can make it difficult to understand an investment’s performance during fluctuations.

3- It is not very useful for short-term investment.