Introduction

Internal rate of return is a metric that estimates the profitability of a project, Business, or Investment. Technically IRR is the discount rate at which the NPV of a project, or business becomes zero. In this article, we will understand the IRR along with examples.

Internal Rate Return

The internal rate of return (IRR) is the annual rate of growth that an investment or any project is expected to generate. IRR is calculated in the same way as NPV is calculated. As we know CAGR takes the beginning value or ending value but IRR is very effective in mutual funds where SIP takes place because SIP generates different returns and at the end calculates IRR after adding all returns and put it into the NPV formula.

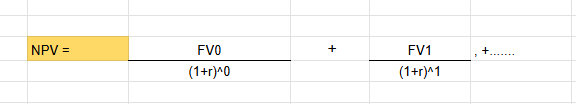

Formula of Internal Rate of Return

NPV – Net Present Value.

FVo – Initial investment

r- Rate

FV1 – Future Cash flow

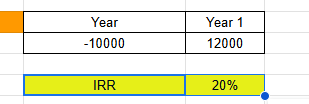

Example 1:- Initial investment is 10000.

IRR Excel calculates 20 % you can simply put a formula in Excel and 10000 is the initial investment and 12000 future cash flow which means simply 10000 becomes 12000 in 1st year in this way you can calculate IRR

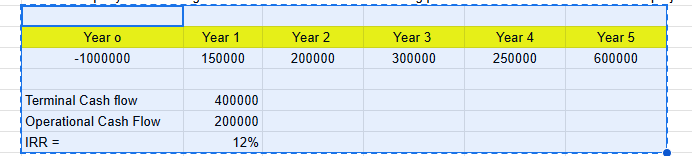

Example 2:- FMCG company is evaluating whether to start a new manufacturing plant. What will be the annual return from the project?

Terminal cash flow is 400000 which is the sale value of the plant which has sold in the 5th year and Rs 200000 comes from operational cash flow from the manufacturing plant, we take terminal cash flow and operational cash flow while calculating IRR. IRR is calculated in Excel it is easy and simple so 12% is IRR. So example 1 is a better IRR than example 2. Investor will go with example 1.

Differences between CAGR and IRR.

Compound annual growth rate (CAGR) and Internal rate of return (IRR) are both used to measure investments but they have different purposes and are calculated in different ways.

CAGR measures the average annual growth rate of an investment over a specific period of time. CAGR is always used by individual investors and fund managers to track long-term growth. While calculating the CAGR investors take the beginning value and ending value.

Internal Rate of Return is a very useful technique and financial metrics that evaluate the profitability of a project, business, or investment. IRR considers all outflow and inflow of the future and calculates the IRR. It indicates the percentage rate earned on each invested rupee over the investment period.

What is good CAGR?

A good CAGR considering 15% to 20% is very strong, a good CAGR ratio varies by industry and market conditions and reflects solid growth over time. In low risk investment IRR 8%-15% is considered good. In higher-risk investments 15% to 25% IRR is good, For venture capital 20% to 30% IRR is good.

Conclusion

Internal Rate of Return is a financial metric that is useful while measuring the profitability of investment, IRR is the discount rate that makes the net present value (NPV) of all cash inflow and cash outflows equal to zero in a discounted cash flow analysis. IRR is very effective in SIP when an investor invests monthly sip in a mutual fund because we know the different return comes out every month and IRR adds all the returns and calculates average annual growth. CAGR is effective in lumpsum and IRR is effective in SIP.